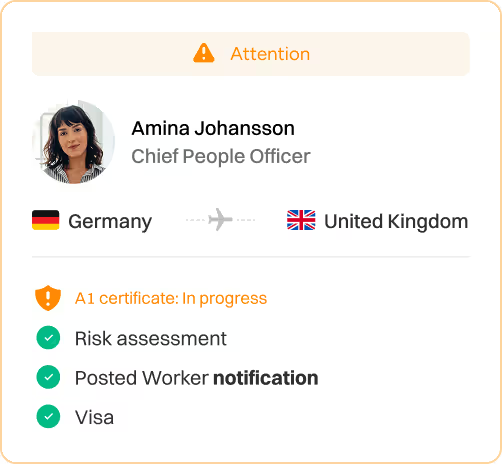

A1 certificates & CoCs

Compliance assessments

Posted worker notifications

Data security

Travel health insurance

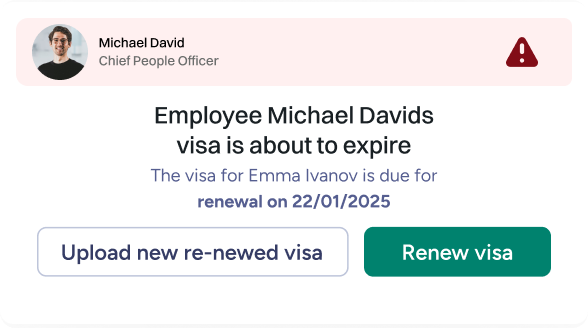

Visa

WorkFlex handles A1 certificates, visas, PWDs, tax requirements, and employee duty of care on your behalf – so your global business knows no borders

Over 5,000 HR and Global Mobility Managers trust WorkFlex to streamline international travel compliance

Solutions

Evaluate compliance risks, generate relevant documents, and maintain an audit trail -

all with a click of a button

Let WorkFlex handle A1 certificates, visas, PWDs, tax requirements, and more for your business trips worldwide. All-in-one platform

You'll be surprised how effortless the process of managing work-from-anywhere compliance can be with our software

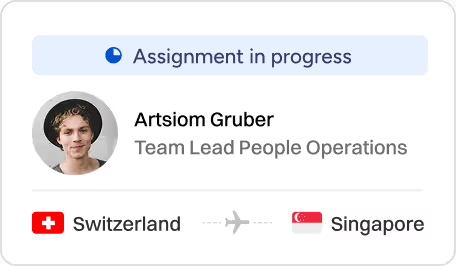

From assignment pre-assessment to ongoing monitoring, streamline expat assignment management with end-to-end compliance automation

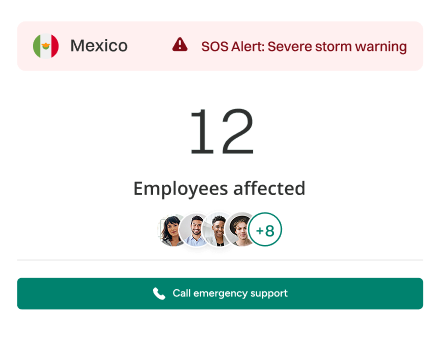

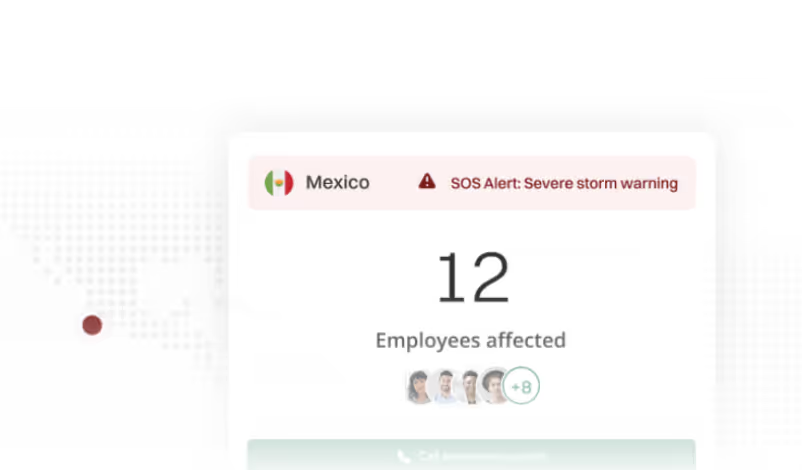

Protect your employees when traveling internationally with early risk alerts, 24/7 crisis support, medical assistance, and real-time monitoring

FEATURES

Get instant alerts when political unrest, natural disasters, or health crises emerge

Multilingual support connects you instantly to doctors and emergency coordinators

Medical coverage by ALH Group Hallesche added to every approved trip, worldwide

Compliance

All the risks associated with business travel, work from anywhere and assignments?

We’ve got you covered

What is the risk? The traveler-employee has no right to work in the destination country, creating an illegal labour situation that is generally very heavily penalised.

What does WorkFlex do? We make sure that your employees have the right to work in the destination country using WorkFlex Visa services.

Here’s what could happen if you don’t prevent this:

What is the risk? The traveler-employee constitutes a Permanent Establishment in the destination country. As a result, you’d have to register the company locally, attribute profits to the local business (branch) and file corporate tax.

What does WorkFlex do? We help you avoid triggering corporate tax liability in the destination country.

Here’s what could happen if you don’t prevent this:

What is the risk? Obligation to set up payroll in the destination country. This implies that you have become an employer there and have to pay wage tax.

What does WorkFlex do? We help you avoid triggering the obligation to set up payroll in the destination country.

Here’s what could happen if you don’t prevent this:

What is the risk? The traveler-employee becomes socially insured in the destination country and/or drops out of the coverage of the home country's social security, both of which are not desirable.

What does WorkFlex do? We ensure that your employees remain covered by their home country's social security scheme.

Here’s what could happen if you don’t prevent this:

What is the risk? Employees that go on a business trip to another EU country to perform some work need to be registered within the destination country's local authorities to avoid legal penalties, fines, and potential legal disputes.

What does WorkFlex do? We ensure that the employee is properly registered before starting the posting of the worker.

Here’s what could happen if you don’t prevent this:

What is the risk? Local labour law becomes applicable to the traveller’s employment. This could result in significant additional financial obligations or in-kind entitlements to the employee, such as holiday pay (depending on the specific laws in the destination country).

What does WorkFlex do? We help you avoid the risk of local labour laws becoming applicable to your employees on their trips abroad.

Here’s what could happen if you don’t prevent this:

What is the risk? Without proper support, traveling employees face health and safety risks abroad. Employers have a duty of care to ensure employee safety and can be liable for costs and damages if this duty is not fulfilled.

What does WorkFlex do? We provide risk assessment, real-time monitoring, emergency support, and country-specific guidance to protect your employees abroad, plus comprehensive travel insurance. This helps employers meet their duty of care obligations.

Here’s what could happen if you don’t prevent this:

What is the risk? Unauthorized access, breaches, theft or damage of data during your employee's trip abroad, as well as ensuring coverage by and compliance with adequate data privacy laws similar to GDPR in the destination country.

What does WorkFlex do? We assess GDPR applicability, review adequacy decisions and destination country laws. We conduct transfer impact assessments and offer employee instructions for GDPR compliance.

Here’s what could happen if you don’t prevent this:

CLIENT STORIES

A team of specialists with 100+ years of combined expertise in tax, legal, and global mobility compliance

Join hundreds of companies managing international travel compliance effortlessly